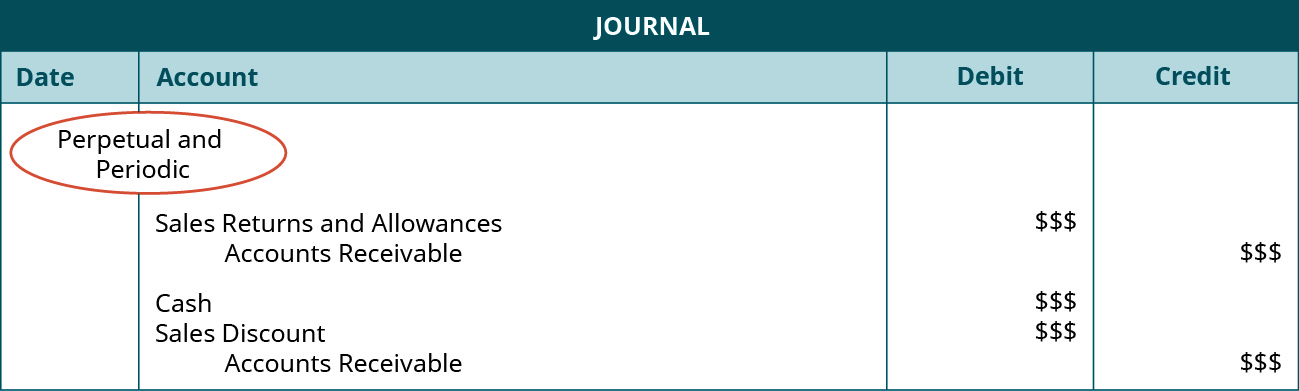

A cash, or sales, discount is one you offer to a customer as an incentive to pay an invoice within a certain time. You must record cash discounts in a separate account in your records and report the amount on your income statement. You’ll record a total revenue credit of $50 to represent the full price of the shirt. However, the debit to the sales returns and allowances account ultimately subtracts $10 from your revenue, showing that you actually only earned $40 for the shirt. When a customer buys something for you, you (should) record the transaction in your books by making a sales journal entry. So, when a customer returns something to you, you need to reverse these accounts through debits and credits.

What is the accounting treatment of Sales Returns and Allowances?

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

What are the Benefits of Factoring Your Account Receivable?

If the customer’s original purchase was made using credit, you recorded the original sale by increasing your Accounts Receivable account through a debit. Since the ledger accounts are closed to the General Ledger, this account balance indicates that there are no more invoices in which credits have not been posted. When merchandise is returned by a customer or an allowance is granted, a credit memorandum (also known as a credit memo) is prepared.

Return of Merchandise Sold on Account

Club A paid the total amount due (which was $10,000) on 10 July 2014. The receivable from Club B was outstanding as at the end of July, when Club A returned 5 and Club B returned 10 footballs. At the end of the period, ABC Co.’s net sales on its financial statements were as follows. If a customer does not agree to exchange goods, the company will repay them or reduce their receivable balance.

Usually, these are a part of the net sales calculation in the notes to the financial statements. Companies do not record this transaction as it does not affect the sales or sales return. On the books of the seller, the customer’s accounts receivable account has a debit balance. small business general ledger accounts examples and more Thus, the term credit memorandum indicates that the seller has decreased the customer’s account and does not expect payment. However, to improve the bookkeeping process, returns and allowances are often recorded in a separate account entitled sales returns and allowances.

- This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers.

- This can be a bit confusing if you’re not an accountant, but you can use this handy cheat sheet to easily remember how the sale journal entry accounts are affected.

- When customers accept damaged products in return for a discount on the selling price, these accounting entries are made.

- Some of the reasons why customers may return goods will include the following.

Purchase returns for when a customer paid cash

Yes, if return goods are given back to the manufacturer by a customer, they have sales returns and allowances journal entries. These should be set-up in the books before any transactions are made. There are two primary types of discounts that might occur in your small business — trade discounts and cash discounts. A trade discount occurs when you reduce your sales price for a wholesale customer, such as on a bulk order. This type of discount does not appear in your accounting records or on your financial statements.

Show the general entries to record sales and sales return in the books of ABC cosmetics. This can be a bit confusing if you’re not an accountant, but you can use this handy cheat sheet to easily remember how the sale journal entry accounts are affected. Finally, if your state or local governments impose a sales tax, then your entry will show an increase in your sales tax liability. Let’s review what you need to know about making a sales journal entry.

Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. Since sales returns and allowance are debited from gross sales, it has a negative balance. Therefore, due to the negative balance, these accounts are also called contra-revenue accounts. Navigating the ins and outs of sales returns and allowances can be a complex journey, but Nick breaks it down with clarity and a touch of fun, involving everyone’s favorite—Xboxes! He takes a detailed look at how sales are recorded—whether in cash or on credit—and sets the stage for understanding how to handle returns and allowances.

A return occurs when a buyer returns part or all of the merchandise they purchased back to the seller. An allowance occurs when a buyer decides to keep damaged or defective goods but at a reduction from the original price. On Feb 2, the journal entry to adjust inventory and record cost of goods sold account.